The Regulatory Horizon for Australian Banks

- Thomas

- Feb 23, 2024

- 9 min read

There is a lot going on in the regulatory compliance and reporting space for Australian Authorised Deposit-taking Institutions (ADIs) …..again! Read on to find out what you need to prepare for in 2024, and beyond.

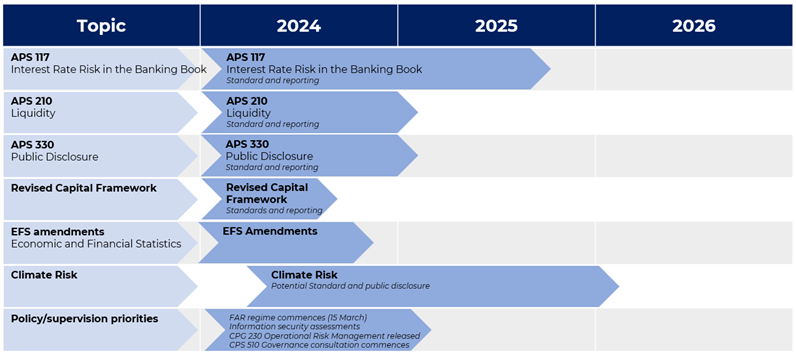

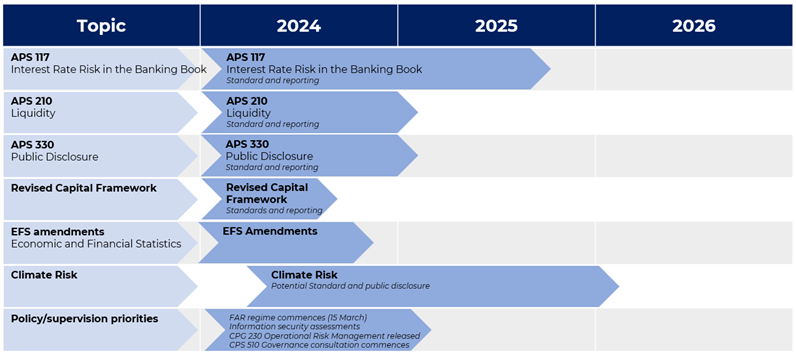

APRA Policy and Supervision Priorities

This year APRA has changed things up a bit. On 31 January 2024 they released their interim Policy and Supervision Priorities, which covers only the first 6 months of the year. This will bridge the gap to the annual Corporate Plan, expected in August, where details covering the focus over the ensuing 12 months will be released. Some of the key areas for the first half can be seen in the timeline below.

One of the biggest changes in the first half for ADIs is the commencement of the FAR regime in March. This increases the responsibilities of the nominated Responsible Persons within an ADI, and all organisations should by now be across the registration and reporting requirements. Despite some delays by Treasury in finalising certain details, APRA expects entities to submit their responsible person registration applications as soon as possible, and by no later than 30 June 2024.

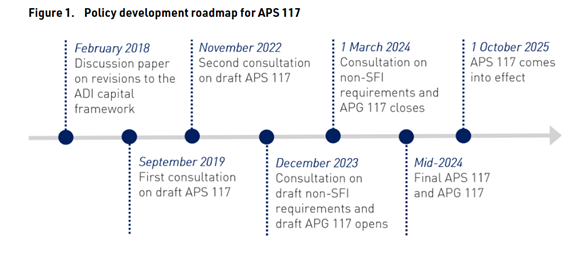

Interest Rate Risk in the Banking Book (IRRBB) APS 117

It has been a long and winding road for the finalisation of the IRRBB changes. The new requirements are due to come into effect on 1 October 2025.

Advanced ADIs

Many of the proposed changes impacting advanced banks in the original APRA consultation paper have been wound back following APRA’s review of the submissions received. The result is that APRA expects the capital requirement for these banks to be largely similar to the existing capital requirement. The change is that there should be reduced volatility in the capital requirement, and it is expected to be between 5-7% of risk weighted assets.

Standardised SFIs

Standardised banks are now caught by the provisions of APS 117. The standardised SFIs (except foreign branches) are required to comply with all aspects of APS 117 with the exception of several paragraphs relating specifically to advanced banks, and attachment A. It includes documentation of their IRRBB management framework. This could require an uplift in the measurement and governance frameworks for these entities, and it is strongly recommended that a review be conducted to identify any gaps.

Standardised non-SFIs

Three paragraphs have been added to the draft standard which relate specifically to non-SFIs. They must manage their IRRBB exposure commensurate with the nature, scale and complexity of their operations, and they must report the IRRBB exposure to the Board or Board committee at least semi-annually. The implication here is that all ADIs captured by the standard must have an appropriate IRRBB measurement model in place. Where APRA believes and ADI is not appropriately managing, measuring or monitoring its IRRBB, or is carrying excessive interest rate risk, APRA may require the ADI to comply with all or specific requirements in the Prudential Standard and/or require the ADI to hold additional regulatory capital, commensurate with the IRRBB risk.

Reporting

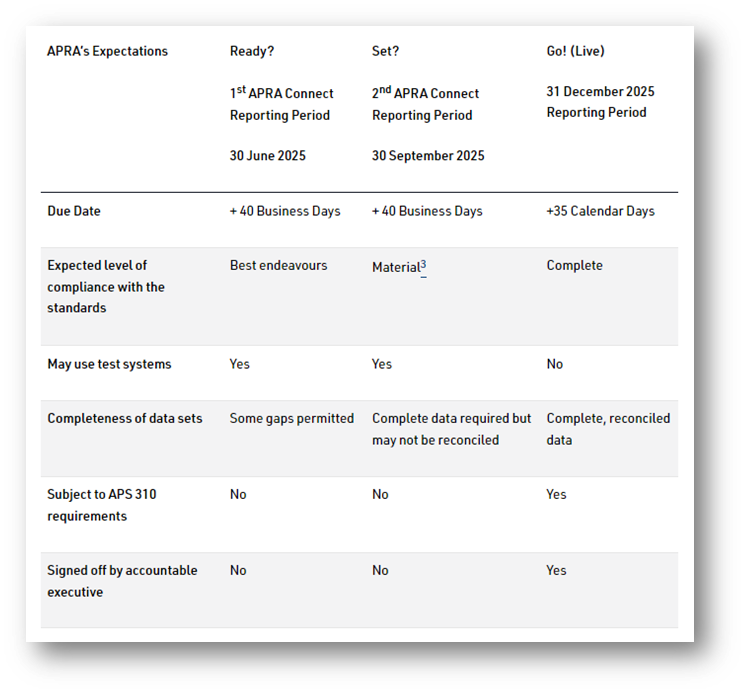

While standardised ADIs do not need to hold capital against their IRRBB exposure, nor report their exposure amounts to APRA, they are required to report under ARS 117, which has changed. The old repricing by AUD and FX is being replaced by repricing schedules on a contractual, and behavioral cashflow basis. The behavioral analysis could pose significant challenges for ADIs. Furthermore, a third table requires a sensitivity analysis, covering 6 interest rate shock scenarios across 17 cashflow tenor buckets, which we expect to require a significant amount of work to develop. There are 3 parallel runs commencing with the 30 June 2025 quarter end, and APRA has spelled out their expectations with the respective submissions.

Liquidity (APS 210)

APRA has noted that the liquidity changes primarily affect entities that follow the Minimum Liquidity Holdings (MLH) regime. The changes are in response to several bank failures in the USA and Europe, with APRA identifying that there is a very real contagion risk if an Australian ADI experiences liquidity issues.

MLH assets to be valued at market value

These assets must be marked to market each period and the revised market value used in the liquidity calculations. Any unrealized losses are to be deducted from tier 1 capital, however, unrealized gains cannot be added to capital. The implication here is that when market values of assets fall, both liquidity and capital ratios will be adversely impacted.

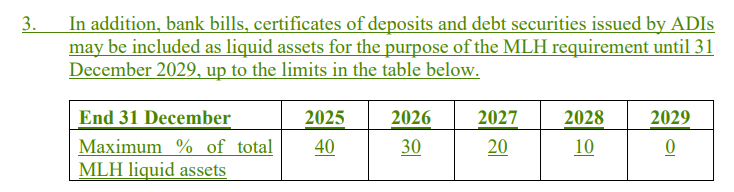

Bank securities no longer eligible as MLH assets

To address the contagion risk concerns, the allowable proportion of bank securities included in the MLH portfolio will have to be reduced to 0% over 5 years up to 2029. APRA has provided a schedule that ADIs must meet and as can be seen, ADIs that currently have a proportion significantly over 40% may experience a large impact in getting down to the maximum 40% by 31 December 2025.

There is also an ongoing financial impact of potentially having to hold higher quality but lower yielding securities such as government bonds. It is strongly recommended that ADIs review the composition of their MLH portfolios, put a plan in place to comply with the run-down schedule, and also assess the financial impact of these changes.

Exceptional Liquidity Assistance from the Reserve Bank of Australia (RBA)

If an ADI experiences liquidity stress, it may request Exceptional Liquidity Assistance (ELA) from the RBA. Before doing so, the ADI must notify APRA of its intention, and provide certain information to APRA. APRA expects all ADIs to have the operational capability to provide this information. This implies that ADIs must have a process in place to submit the request, in case a request is required. Instructions and the relevant reporting form have been provided in the consultation documents.

Revised Capital Framework (APS 110/112/113)

Several minor changes are being proposed to the Prudential and Reporting Standards, and Guidance covering capital and credit risk, following on from the implementation of the Revised Capital Framework in 2023.

ARS 110

Item 5 'Other charges as required by APRA' is now sub-divided into 5 risk categories. i.e., credit, operational, market, IRRBB and all others.

APS 112

For unrated corporate (non-SME) exposures, ADIs now have the option of applying an 85% risk weight if they can identify the exposures as investment grade. Non-investment grade exposures would be risk weighted at 110%. ADIs may continue to use the existing 100% risk weight if they so choose. ADIs should analyse their exposures to determine if applying the new, more risk sensitive, weightings is beneficial.

A clarification has been included in footnote 5 of Attachment A in APS 112, specifically addressing the valuation of a property for Loan-to-Value Ratio (LVR) purposes. The value used must not be higher than the effective purchase price, except for non-arm’s length transaction.

APS/APG 113

A range of updates are being proposed for the advanced IRB approach:

APRA has expanded the criteria / definition for classifying a borrower as domestic large public infrastructure that provides essential services to the economy.

APRA has recognised the recoverable value of carbon credits and allowances for LGD estimates and collateral haircuts.

APRA has recognised the application of the 1.1 scaling factor for New Zealand exposures subject to the RBNZ’s supervisory slotting approach.

APRA to allow a 5% sovereign LGD for exposures to the BIS, IMF and the World Bank Group. No change for other entities (possible system change).

Public sector entities that carry out the functions of a financial institution will be classified as a financial institution exposure after this change.

ADIs are expected to assess any interdependency (or interconnectedness) in line with the relevant credit policies and consider if properties should be aggregated.

Three new paragraphs added to explain the prudent use of supervisory LGD and EAD estimates.

APRA has provided guidance and its expectations on the controls to be applied around the business function approval of ratings.

EFS Reporting Amendments

Minor changes have been made to ARS 701 and RPG 701. APRA has aligned the EFS business size definitions in ARS 701 to the new capital framework thresholds to achieve consistency. Regarding covered bonds, APRA has also removed the reference to the Banking Act, and recognised that covered bonds can be issued by entities other than ADIs. Both of these changes are effective for reporting periods beginning on or after 30 June 2024.

The bigger change is to the EFS data priority listings, affecting numerous attribute codes, concepts, dimensions, and dimension members. While some priorities have decreased, there is a much larger number of priorities that have increased. The changes are wide ranging and have implications for the data management framework within ADIs. In all there are 258 items that have increased in priority to either high or very high. It is strongly recommended that ADIs review their data, determine which items they are affected by, and formulate a remediation plan as necessary. ADIs need to comply with the new priorities for reporting periods ending on or after 31 October 2024.

Data Collection Roadmap

In March 2022, APRA released a discussion paper, unveiling a five-year roadmap aimed at acquiring detailed data at a granular level. The plan involved a complete transition from D2A to APRA Connect by 2027.

In December 2022, APRA revealed a more comprehensive plan in a response paper, confirming the approach initially announced in March 2022. A 31 July 2023 update has advised that APRA is currently reassessing its strategy for executing the data collection program and has recognized various challenges arising from the integration of new technologies into the implementation of this intricate program for collecting granular data.

These delays have been caused by internal capacity/capability limitations within APRA, so to enhance their capabilities, APRA has established a new Technology & Data Division to strengthen these capabilities. Consequently, there will be adjustments to the previously announced timeline for data collections and they have advised that for Comprehensive Credit Collections, industry engagement is anticipated to commence no earlier than 2025.

The outcome of APRA's review process is expected to be released in April 2024.

Pillar 3 disclosures (APS 330)

APRA is aligning its Pillar 3 disclosure requirements with the international standards issued by BIS. This change affects all the Significant Financial Institutions (generally, banks with assets > AUD $20 billion).

The new disclosure templates align with the BCBS templates, and a significant uptick in reporting requirements will especially impact the mid-sized banks who use the Standardised Approach to Credit Risk, with new quantitative and qualitative disclosure tables required on quarterly, half-yearly and yearly basis. In this article - we explored the new APS 330 requirements in more detail: APRA adopts BIS Pillar 3 disclosure standards. The new Pillar 3 requirements coming into effect on 1 January 2025.

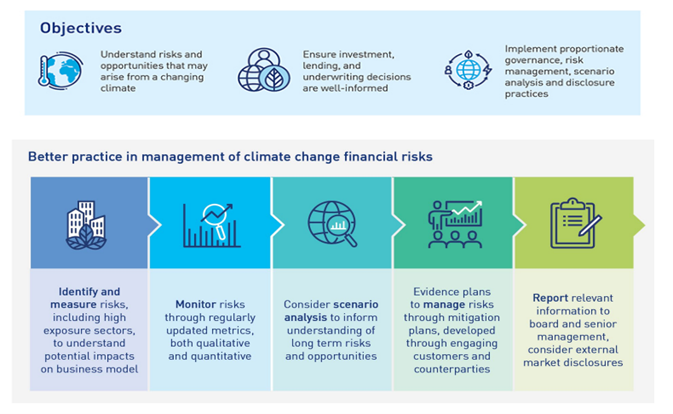

Climate Risk

APRA has an existing publication, CPG 229 Climate Change Financial Risks. In this guide they spell out the objectives of having a climate risk management framework, and what they consider to be the

APRA identifies the specific risks potentially impacted by climate change or climate events as;

• Credit risk – potential defaults on loans and decline in collateral values

• Market risk – potential repricing of financial instruments and corporate debt

• Operational risk – supply chain disruption

• Liquidity risk – difficulty in liquidating assets affected by climate events

• Reputational risk – the ability to attract and retain customers and employees due to changing expectations around climate response

In November 2023, the Basel Committee on Banking Supervision (BCBS) released a consultation paper titled "Disclosure of climate related financial risks”. Their rationale for requiring public disclosure of these risks is that they recognise that climate change and climate events can impact many risk areas; the same risk areas that APRA lists in CPG 229. The Basel Committee also recognises that there is currently no mechanism for banks to make consistent and comparable disclosures of these risk impacts. They see mandating disclosures within the Pillar 3 framework as a way to overcome these shortfalls in climate risk disclosure.

The Committee has invited discussion on both qualitative and quantitative disclosures. Qualitative disclosures are suggested to cover governance, strategy, risk management and concentration risk policy, which would help ensure that bank disclosures are sufficiently comprehensive and meaningful. Quantitative disclosures under consultation include; exposure by industry sector, disclosure of emissions by counterparty type (financed emissions), exposures subject to physical risk by geographical location, and forecasts to assess counterparty transitioning impacts. The Committee has also requested feedback on the feasibility of a commencement date of 1 January 2026.

An underlying implication for Australian SFIs stems from APRA’s recent change to APS 330, where they have linked the APS 330 disclosures to the BCBS Standard titled “Disclosure requirements”, rather than spelling out its own disclosure expectations. This means that whatever climate risk disclosures the BCBS lands on, may be automatically applicable to Australian SFIs, unless carved out by APRA. It is also unclear if Australian SFIs would need to follow the same implementation timeline stipulated by the BCBS, or if APRA would impose their own commencement date.

Recap

As you can see, there is a lot to do, and largely at the same time.

To successfully implement change of this breadth and magnitude, a comprehensive plan covering all 5 pillars of regulatory reporting is required. A weakness in one area will threaten the success of your change program.

How can we help?

APRA is rolling out its program aimed at reforming its prudential and reporting structure. The regulatory reporting landscape is emerging as a distinct area of emphasis for entities. Under the FAR regime, responsible persons bear personal responsibility, so it is crucial for entities to establish robust systems/processes for their regulatory submissions, public disclosures, and governance frameworks. RegCentric can support your organisation in transforming regulatory challenges into strategic opportunities.

Backed by a team of experts in both APRA regulations and technology, RegCentric provides cost-effective, flexible, and scalable services and solutions tailored to your specific needs. Whether complementing your existing teams, uplifting governance documentation, or delivering our award-winning technology solution for reporting, we deliver enduring solutions to address your requirements.

To start a conversation about how we can support you, contact us today.

Comentários